Greg Norman was recently named CEO of LIV Golf Investments, a Saudi government-backed group looking to create a $200 million, 10-event golf series on the Asian Tour.

Without getting into the details, this venture is aimed at attracting the best players in the world – those currently competing on the PGA and European Tours – to play events on the Asian Tour.

Obviously, if the best players in the world are traveling to Asia, the Middle East, and parts of Europe to play Asian Tour events, they aren’t competing on their regular Tours those weeks.

That’s a potentially devastating problem for the PGA and European Tours.

Can you imagine the best players in the world taking at least two and a half months off their regular Tours to play at events all over Asia?

That thought is likely keeping Jay Monahan, Commissioner of the PGA, awake at night.

It shouldn’t. Here’s why.

In interviews, Norman says all the right things.

“(I)f we have an opportunity to invest and grow the game of golf through our investment dollars in Asia, God bless us,” Norman is quoted in Golf Digest.

He even invokes the ghost of Seve Ballesteros as a co-sponsor of sorts to this breakaway Tour.

“Seve and I were staunch supporters of that, of growing the game of golf on a global basis. The tours should keep their eyes wide open, because the Asian Tour will be there.”

God and Seve were both unavailable for comment on their shared vision of a Saudi-backed abbreviated Asian Super Tour.

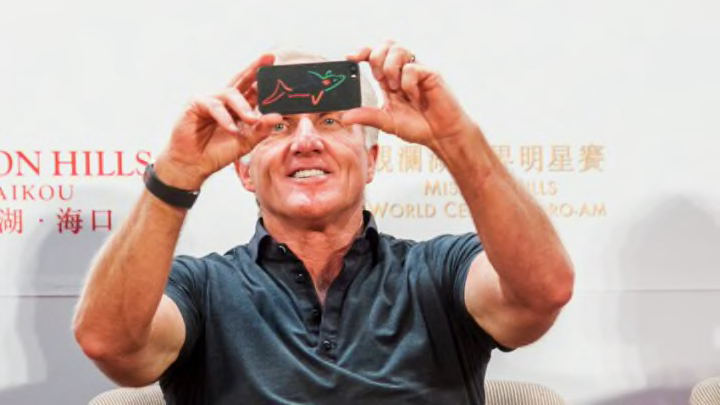

Greg Norman is 66 years old. His legacy is established and crystal clear. Norman is remembered now, and will be forever, for two things – (1) His rollercoaster career marked by supreme golfing talent and epic meltdowns in majors and (2) his love of money.

Norman, a two-time Open Championship winner and Golf Hall of Famer, remains an outsider of sorts. Though he was one of the biggest names in golf from the mid-80s to the mid-90s, he stands apart from other multiple major winners of his generation like Seve, Faldo, Daly, Price, and Payne Stewart.

Norman, unlike his accomplished contemporaries, seemed intent on being defined more by his business prowess than his golf legacy.

It led to Greg Norman restaurants, sunglasses, apparel, golf course design, waterparks, real estate, vineyards, and even a Waygu beef brand. By any measure, he’s been wildly successful in the business world.

We know this because in the last 25 years we’ve seen him on yachts and private planes more than we’ve seen him hitting prodigious drives on the course.

It’s not a crime to love money. We need people like that in the world to shake things up, create businesses and jobs, and make the world go ‘round.

But know this, Greg Norman isn’t barging onto the golf stage again for purely altruistic reasons. The Shark smells blood in the water. Specifically, Saudi money.

An investment of $200 million from Saudi financiers is the equivalent of betting couch cushion change on a long shot horse race. The fact that they have chosen Greg Norman as the CEO tells you that they know it’s a long shot, too.

If it all disappears in an instant, the investors won’t likely feel the pinch. Public Investment Fund (PIF), the Saudi government group behind this venture, is worth an estimated $500 billion.

To put this investment in perspective, $200 million might be enough to buy a middling Major League Soccer franchise.

The PIF and Greg Norman know that $200 million sounds like a huge investment to regular people, but in the world of global sports league valuations, it’s a rounding error.

Then again, what would the payoff be if all the top players from the PGA and European Tours jump to play in the new “mini” Tour – 10x?

That’s the point. This whole thing is a flyer funded by people who know and care little about the game, fronted by a famous golfer who is more known for his outlandish eponymous business ventures.

All the kerfuffle will have some fall out.

The PGA will have to look at itself and make sure it’s not vulnerable to other start-ups. It’s always a good thing for fans when a virtual monopoly suddenly encounters a threat. Hopefully, it will drive further innovation that benefits players and fans.

PGA purses will be going up. Not solely based on this threat, but also in addition to the game growing in popularity.

Greg Norman will cash a huge check regardless of the outcome. That should satisfy him and, even in failure, he can claim to have “pushed the game forward” in his own mind.

This too shall pass for the game of golf. Greg Norman is not Gary Player – the true global ambassador of growing the game. And the Saudi government PIF is not the Royal and Ancient, obsessed with protecting the game from those who would bastardize it for a buck.

The best advice I can give current players is the same I would give to those on a sightseeing boat tour in the Great Barrier Reef. If you see a shark, don’t panic. Just stay in the boat. You are much better off where you are.